State of Suptech report 2023

The Cambridge SupTech Lab’s State of SupTech Report 2023 presents insights on the evolution and current state of the digital transformation of financial supervision worldwide. The Report provides a global snapshot across several facets of supervisory technology, including underpinning digital infrastructure and technologies, supported supervisory use cases, approaches employed for developing and deploying suptech applications, the related challenges and risks, and the benefits gained by suptech adoption.

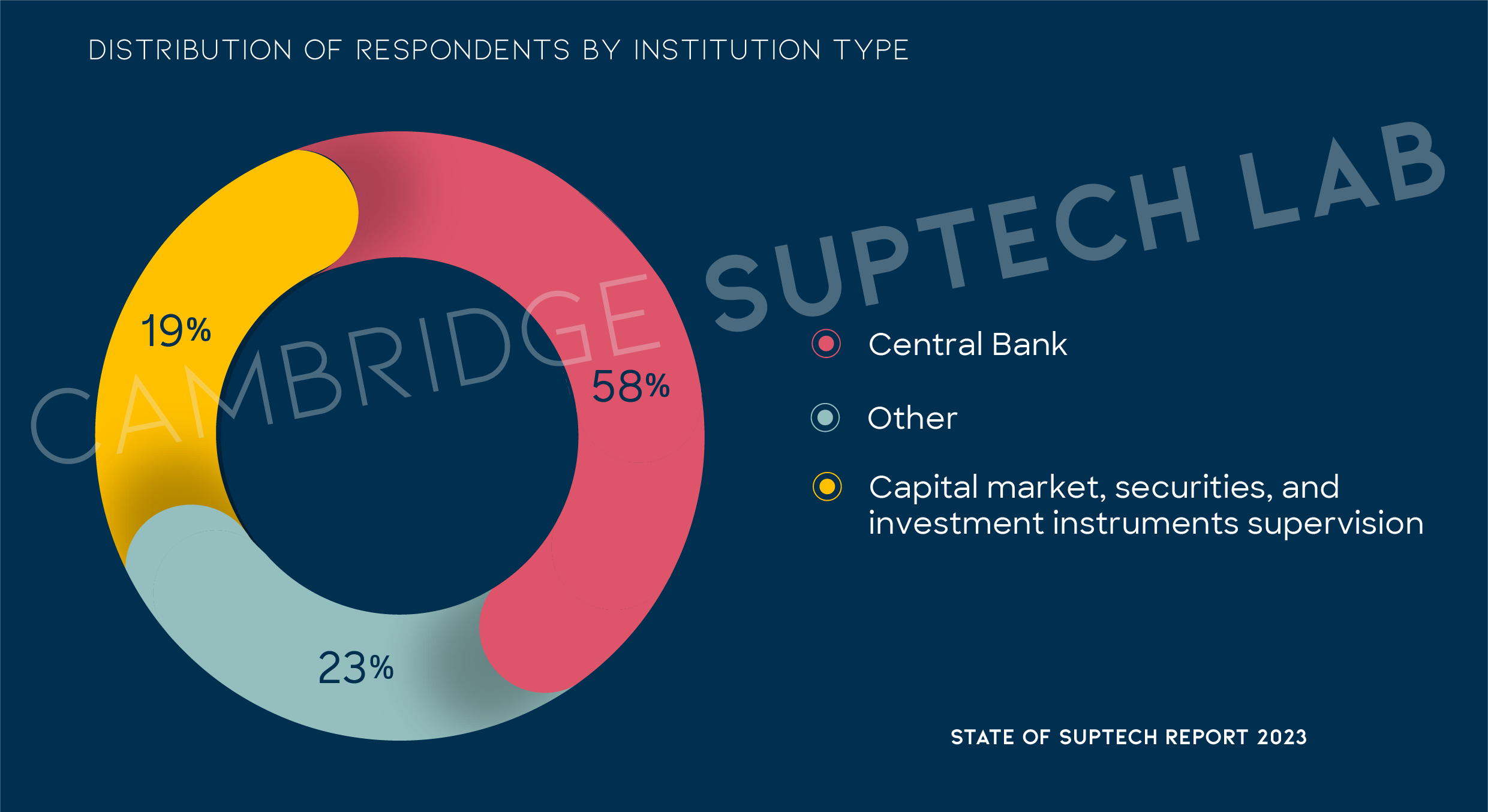

The State of SupTech Report 2023 focuses on how the development and implementation of financial suptech is evolving across the globe, extracting insights from the information provided by 64 financial authorities such as central banks, securities and capital market authorities, financial conduct authorities, and insurance supervisors from six continents. The survey responses boast a robust and geographically diverse representation of financial authorities, representing financial sector oversight for a significant population of approximately 2 billion people.

This year’s survey leverages the State of SupTech 2022 Report as a baseline to provide a picture of emerging trends, persisting and new challenges, maturing strategies, and attained impacts. Compared to last year, the 2023 survey included five times more questions, allowing for a substantially more detailed and expansive analysis.

key findings

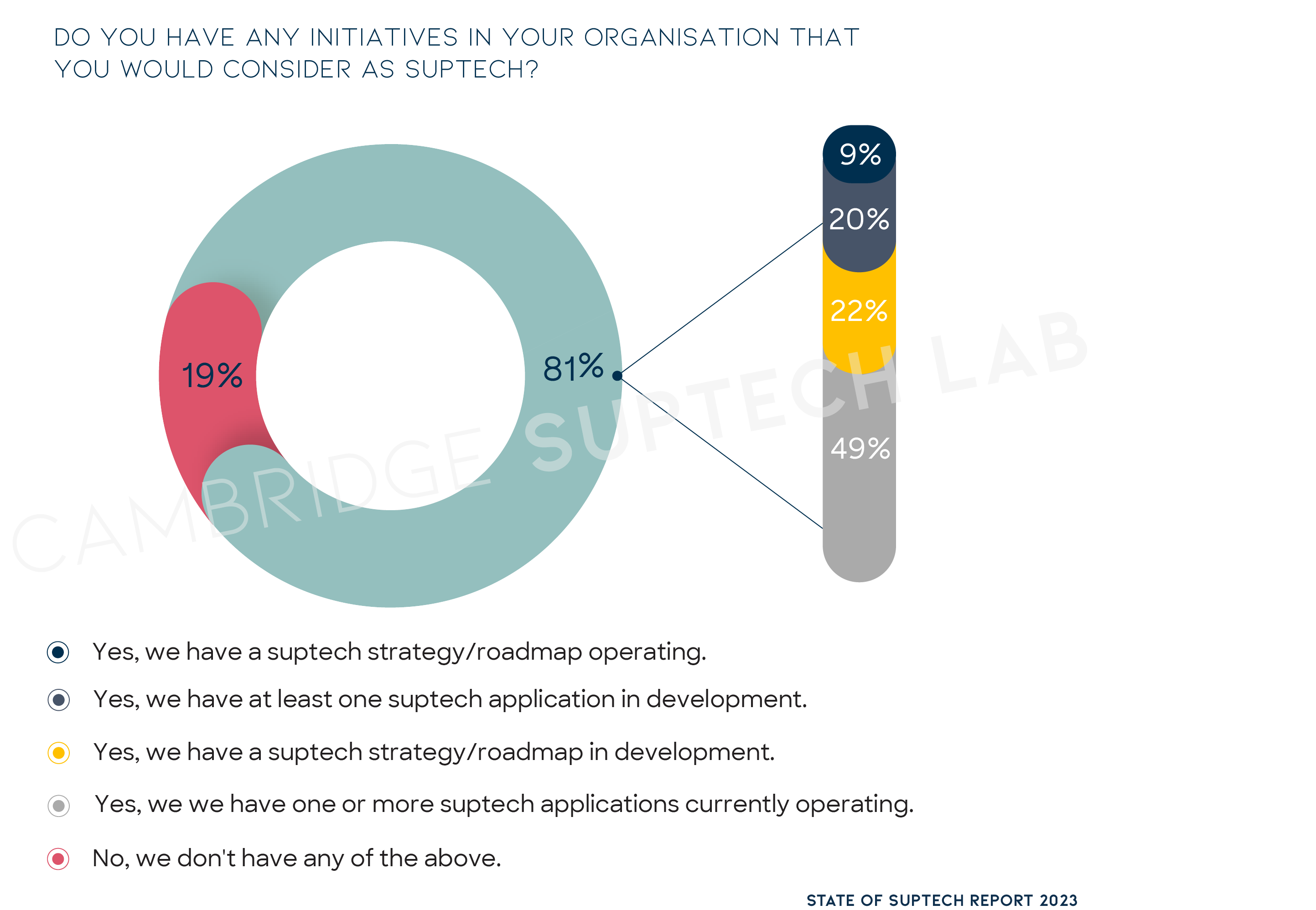

The positive trend in the adoption of suptech continues. 81% of surveyed financial authorities indicate their involvement in various suptech initiatives, an increase from the 71% reported last year. But only a small percentage (9%) of organisations have formulated a comprehensive suptech strategy or roadmap.

Implementations remain in first- to second- generations of suptech, namely descriptive analytics, dashboards, on-premise relational databases, web portals, and static reports. However, Generative AI is slowly entering the suptech scene as a form of fourth-gen suptech (7.6%).

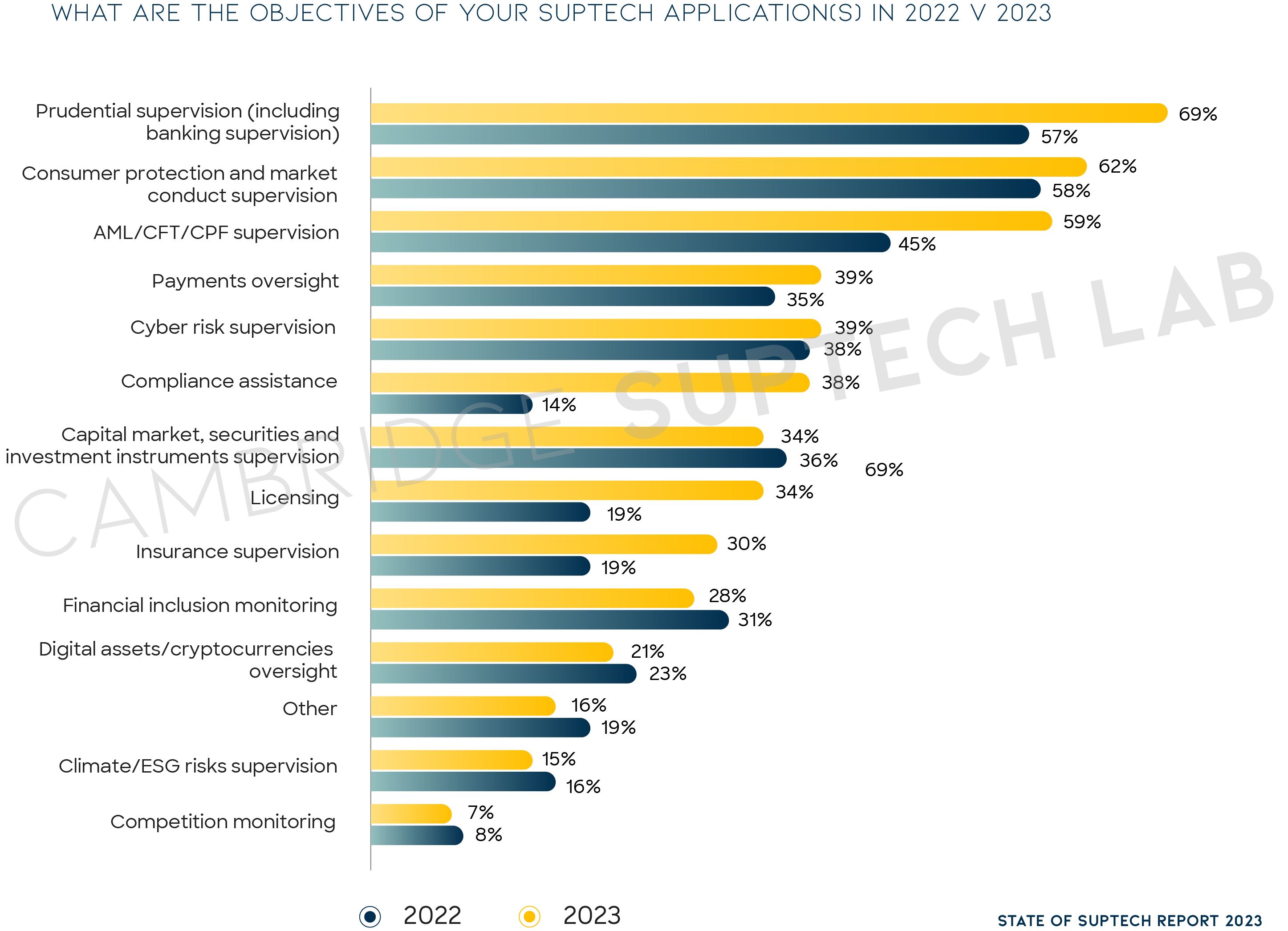

The focus of suptech use cases remains on consumer protection and prudential banking supervision. Additional uses cases centre on anti-money laundering/counter-financing of terrorism/counter proliferation financing (AML/CFT/CPF) supervision, and cyber risk supervision, while progress is being made to advance use cases related to financial inclusion. More work needs to be done to prioritize digital assets and cryptocurrency oversight, as well as efforts related to Environment, Social, and Governance (ESG) goals.

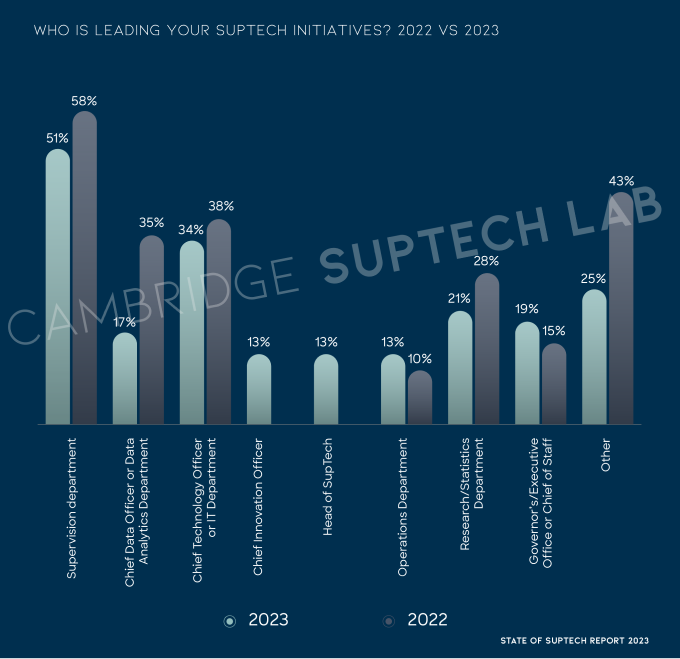

Cultural shifts are beginning to happen in leadership, training, and interdisciplinary collaboration to ground suptech adoption in the context of broader digital transformation of the agencies.

Suptech adoption is making an impact, particularly in the speed with which financial authorities are able to respond to emerging risks and take supervisory action. More efficient information flows between consumers and supervisors is also leading to improved consumer protection and increased confidence in financial markets.

Case Studies

- Bank of Ghana

- European Central Bank

- US Federal Reserve System

- Indonesian Financial Services Authority

- National Association of Insurance Commissioners

- Payments Canada

- Bangko Sentral ng Pilipinas

- Securities and Exchange Commission Philippines

- Superintendence of Banking, Insurance and Private Pension Funds Administrators of Peru

- The Hong Kong Monetary Authority

- The Monetary Authority of Singapore

resources