On 10 April 2024, the Financial Stability Board hosted the “Roundtable on Artificial Intelligence and its Role in a Changing Financial System” at the Central Bank of Ireland. Matt Grasser joined the conversations and presented some of the ongoing work from the Cambridge SupTech Lab to outline the benefits as well as the risks of AI in finance.

During his talk, Matt emphasized the need to center concrete use cases and necessary value creation rather than the particular technology when addressing the need for strategic decisions. Stating the concrete desired outcomes up front and explicitly affords leadership and stakeholders to engage more deeply in assessing a library of available technologies, moving beyond generalized questions of the merits of “AI” in favor of more pragmatic questions such as, “Which technology available on the market today can be adapted to help us address this specific supervisory need?” In answering this question, public sector authorities should next take reasonable steps based on their own respective agency’s governance frameworks and risk appetite to then diagnose this need, identify integrations with existing processes and infrastructure, build prototypes, and run limited live trials in a controlled environment. This enables thorough, evidence-based assessments based on practical, lived experience rather than relying solely on exogenous industry insights and market pressures.

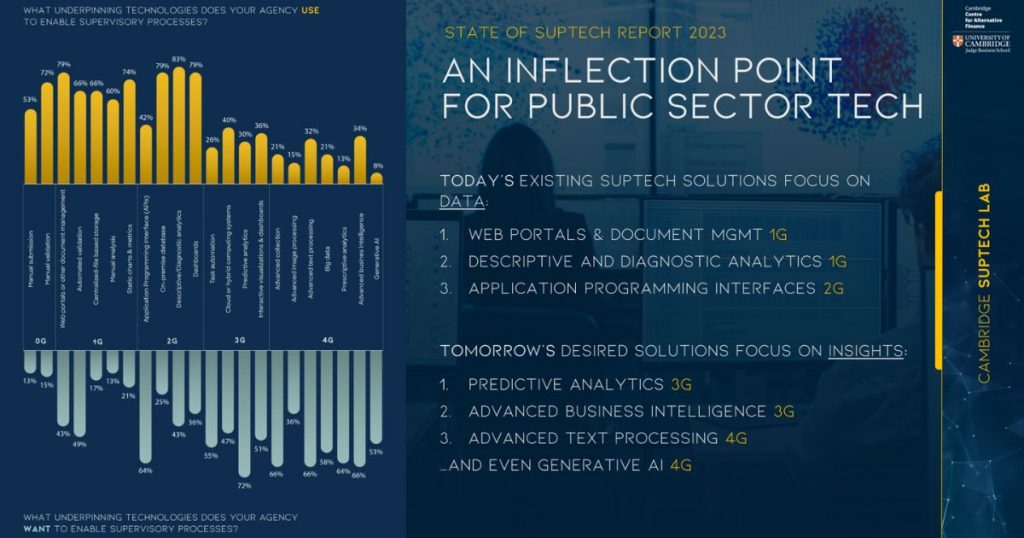

Throughout his visual presentations, Matt noted the expanding role of AI in financial supervision as the public sector reaches an inflection point in its journey towards digital transformation.

Survey results from the Cambridge SupTech Lab’s State of SupTech Report 2023 indicate that most financial authorities have focused their suptech efforts to date on data collection and summarization. But today’s suptech demands are beginning to look beyond the data, focusing on a need for coordinated, actionable insights surfaced through more advanced technologies. Taking the next step requires coordination and collaboration explored through transformative, actionable strategies.

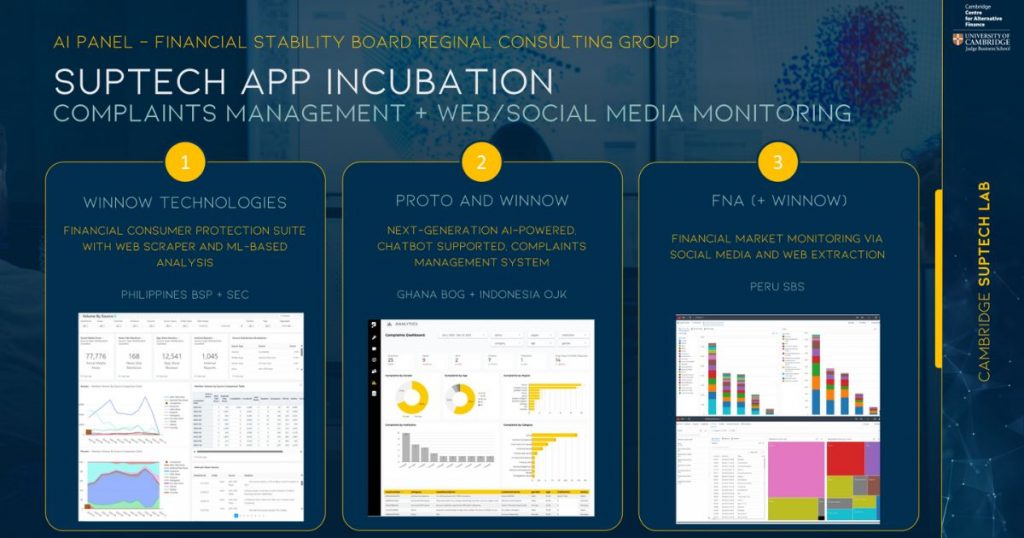

The shift towards advanced technologies such as AI in financial supervision is already underway. For example, the Cambridge SupTech Lab worked with five financial authorities and three vendors using AI in finance to produce a Consumer Protection suptech suite, including a social media and web scraping engine, an AI-augmented complaints management system, and advanced market monitoring network-based analytics tools. The suite included advanced analytics such as topic modeling and sentiment analysis to extract actionable insights from raw text data on social media, app store reviews, and other web-based sources. A chatbot and complaints management system also addressed inquiries via a generative AI engine in a fashion similar to retrieval augmented generation, or RAG. Finally, the suite connects insights from the work with network and trend analyses of historical proprietary supervisory data.

In summary, Matt outlined the need to address particular areas of risk as the evolution of AI in finance continues. The first area is moving from hype and experimentation to a more mature understanding of capabilities versus limitations and how to map resources against needs. Another significant risk is the embedded systemic, societal biases that are a fundamental threat to the accuracy – and ethics – of AI. Humans design and train AI systems on data that necessarily, if unwittingly, echo human biases, as with creditworthiness tools. Adopting suptech solutions, AI, and other digital tools is not only a function of time but also of processes that are mindful of consequences.

To learn more about artificial intelligence in SupTech, please read the following articles:

Artificial intelligence in suptech: the need for public sector adoption and adaptation

Navigating the intricacies of AI in suptech

Generative AI in financial supervision: a brief history of a revolution in progress