Author: David Chipinde

Africa’s SupTech Trajectory: Key Insights from SupTech Week 2024

The technological aspects of financial supervision across Africa are gathering momentum, revealing a fascinating landscape of innovation, challenge, and extraordinary potential. As we unpack the insights from SupTech Week 2024, a compelling narrative emerges of how African financial authorities navigate the intricate digital transformation world.

The current state of technological adoption and emerging challenges

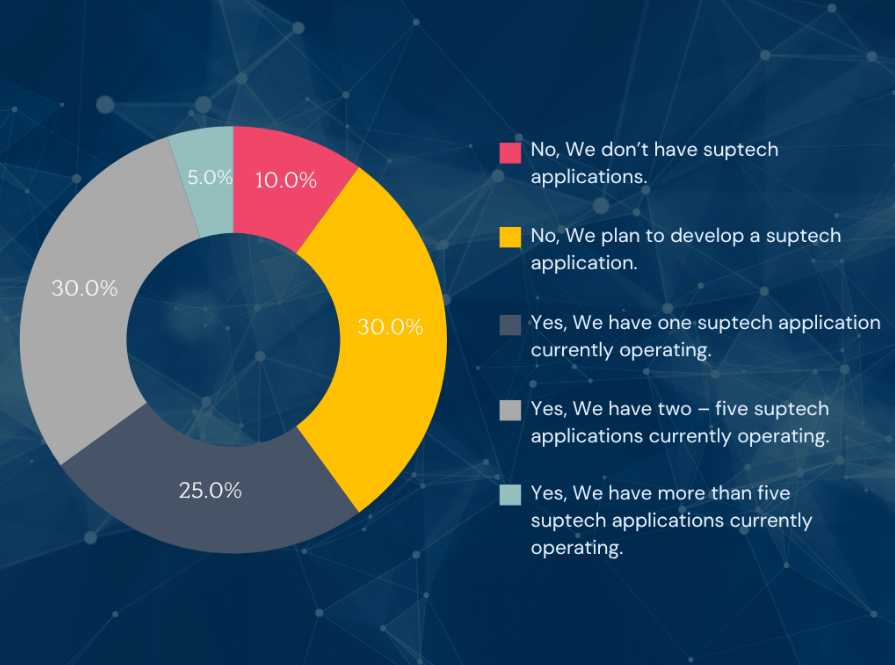

The current state of technological adoption presents a nuanced picture. Approximately 60 per cent of the responding African financial authorities in the State of Suptech 2024 survey have at least one operational suptech application (See figure 1). Nevertheless, the depth of technological integration remains relatively nascent. Most supervisors in the region operate at 1G or 2G maturity levels, characterised by a significant reliance on manual data collection and static reporting mechanisms rather than advanced automation and AI-powered tools.

Figure 1: At a glance – Suptech adoption in Sub-Saharan Africa

Picture Source: Cambridge SupTech Lab – State of SupTech Survey 2024 results (N=20)

A critical insight into the strategic preparedness of financial supervisors reveals a telling distribution of technological planning across Africa’s regulatory landscape: while 40% of responding authorities in Sub-Saharan Africa have implemented an active suptech roadmap (demonstrating a committed approach to digital transformation), and another 25% are in the process of developing their strategic framework, a substantial 35% have yet to formulate any comprehensive suptech strategy, a stark contrast to the more robust digital transformation approaches evident in advanced economies. As indicated in the State of SupTech report 2024 executive summary, this uneven implementation of strategic frameworks represents a key factor contributing to the technological lag in African financial supervision, as these strategic frameworks are critical in enabling the broader deployment of suptech applications by providing a foundational blueprint for innovation and resource allocation, thus highlighting the significant work that remains in achieving comprehensive technological integration across the continent’s financial authorities.

As indicated in the report, this technological journey is punctuated by formidable challenges across emerging economies: limited infrastructure, substantial skills gaps and constrained financial resources. The disparity in roadmap development mirrors the broader technological landscape, underscoring the need for targeted support, capacity building, and strategic interventions.

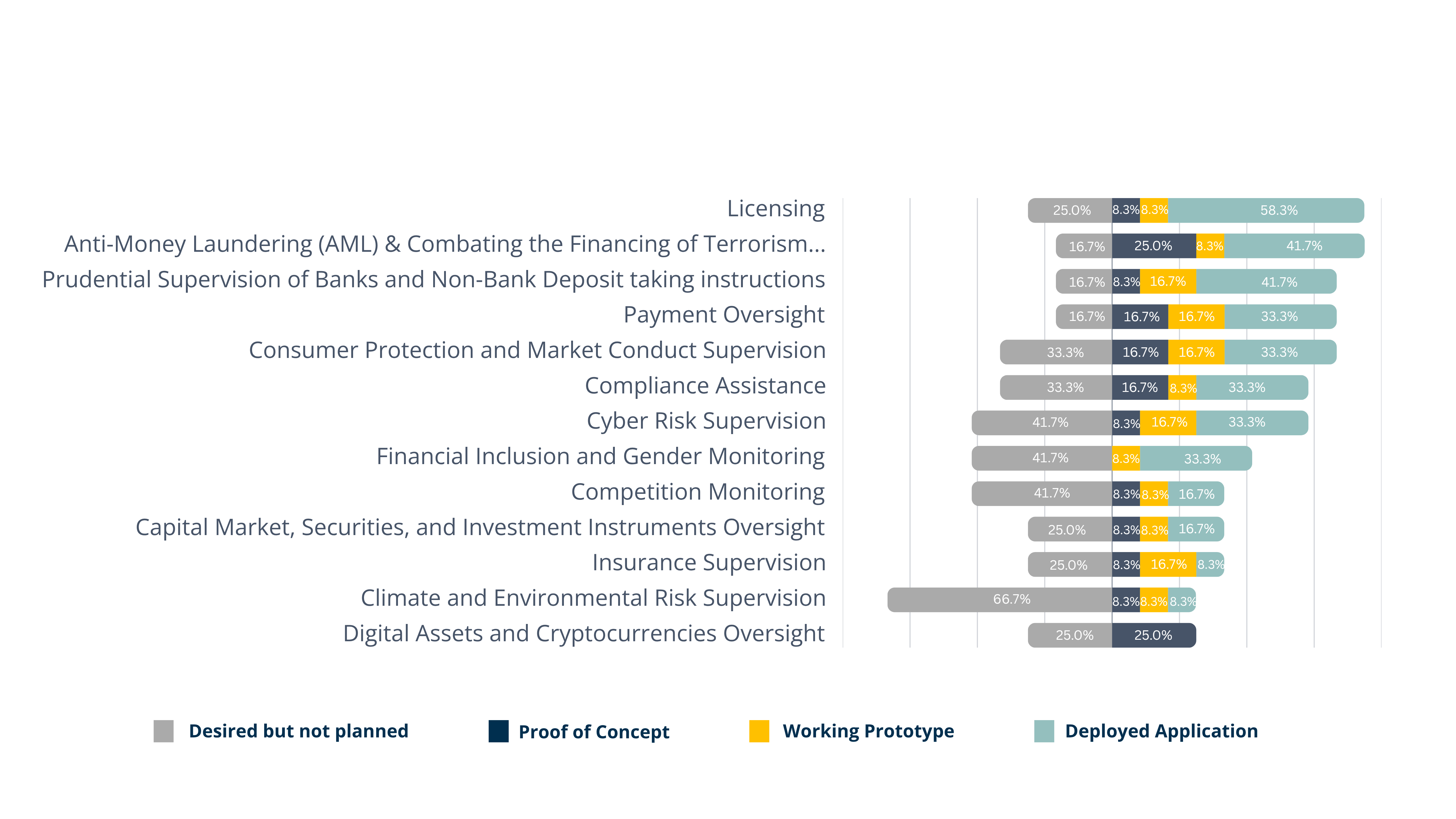

The focus of suptech adoption in Sub-Saharan Africa has been strategically concentrated on key regulatory domains. Licensing, anti-money laundering (AML) and counter-terrorist financing (CFT) compliance, and prudential supervision have emerged as the primary areas of technological intervention (Figure 2). However, the landscape reveals significant gaps in emerging technological frontiers. Areas such as climate risk and digital asset supervision remain underexplored, presenting both a challenge and an opportunity for more comprehensive technological integration in financial regulatory frameworks.

Figure 2: Relative product lifecycle stage of suptech solutions by supervisory domain

Picture Source: Cambridge SupTech Lab – State of SupTech Survey 2024 results (N=12)

The uneven landscape of technological readiness and national efforts

One of the ways proposed to unlock Africa’s suptech potential was bridging the suptech readiness gap, across institutions and jurisdictions.

The suptech landscape across Africa is far from homogeneous. West African countries present a fascinating case study, with nations like Ghana and Nigeria showing advanced suptech tools, while countries like Sierra Leone are establishing foundational digital strategies. The West African Monetary Institute (WAMI) has been instrumental in addressing these disparities, establishing supervisory colleges, and proposing regional regulatory sandboxes for digital supervisory tool evaluation.

National efforts further underscore the continent’s commitment to technological transformation. The Bank of Uganda is transitioning to API-driven reporting, Kenya’s Sacco Societies Regulatory Authority is developing centralised electronic data warehouses with in-built business intelligence tools to automate analysis and compliance tracking, and the Bank of Namibia has implemented a centralised digitised system to minimise reporting errors. These initiatives reflect a broader trend towards more dynamic, responsive, and technologically sophisticated financial supervision.

The Africa SupTech Accelerator: Bridging the digital divide

In response to the technological challenges, the idea of an Africa SupTech Accelerator was presented as a structured way to fast-track the development, deployment, and scaling of suptech solutions tailored to the region’s regulatory needs. This innovative framework represents a strategic approach to bridging the digital divide, bringing together financial supervisors and technological innovators to create bespoke solutions tailored to the unique African market landscape.

To succeed in Africa’s suptech development, the accelerator must work with individual financial institutions and regulators to define priorities, resource gaps and implementation programmes. The accelerator would be anchored on several key principles:

- Targeted Solutions – The need to focus on Africa’s most pressing regulatory challenges with consumer protection in mind. “Consumer protection is evolving. Regulators are moving beyond just tracking complaints to treating each complaint as a diagnostic tool – using them to inform policy and indentify systemic risks. The challenge now is turning these insights into actionable regulatory responses.” Dr. Juliet Ongwae, Cambridge SupTech Lab

- Co-Design Approach – Involve entire financial ecosystems (e.g. financial supervisors, innovators and financial service providers) in designing and rolling out local solutions to local problems.

- Transformative long-term impact – Lean towards sustainable and scalable solutions that can be deployed or tweaked easily to suit more than one jurisdiction.

- Regional inclusivity – Emphasise a regional approach and the design of cross-border suptech solutions in thematic areas such as anti-money laundering and ESG considerations.

Some pain points still need to be addressed from the regulators’ standpoint to sustain this technology adoption trajectory. For example, many regulators in the region frequently ask, ‘Where do I begin?’. In such cases, initial diagnostics and gap analysis point out the best course of action to take.

Looking ahead, the case of an Africa SupTech Accelerator is a step in the right direction towards bridging the suptech adoption gap. This journey would require regional collaboration and resource mobilisation, refining the accelerator model to suit market needs and moving towards implementation soon.

Innovation in action: The case of gender-disaggregated financial data

The SupTech Week 2024 session on “Rethinking Financial Data” explored how supervisors can leverage technology to collect and analyse gender-specific financial data, ensuring that policy interventions address disparities in access, usage, and risk exposure. This discussion brought together experts from Rwanda’s National Bank (BNR), the Dominican Republic’s Superintendency of Banks, and World Bank’s CGAP, offering a comparative perspective on the role of suptech in enabling better financial decision-making.

The discussion enabled participants to explore some successful use cases of gender-specific data. One such case is Rwanda, where the BNR is making progress towards actively collecting and analysing gender-specific data. These efforts have come a long way, from waiting up to four years to receive gender-aggregated survey data, to now transitioning towards a centralised electronic data warehouse that allows real-time access to metrics related to financial inclusion and gender-specific attributes. This information is presented through the NBR Financial Inclusion Dashboard. To achieve gender-based tracking of financial transactions, Rwanda has capitalised on the use of its national ID system as a unique identifier.

“Studies show that financial institutions with greater gender diversity perform better and contribute to more stable financial systems. Yet, most regulators lack visibility on gender-specific financial patterns.” – Tatiana Alonso Gilbert, CGAP

Whereas there is common ground that suptech is a game-changer for gender-inclusive financial supervision, data collected to enable this should be actionable, accessible and facilitate easy decision-making. Simply put, collecting gender-disaggregated data is not enough. Currently, most regulators lack the infrastructure to make inferences from disaggregated data continuously.

There was also consensus that strategies such as advanced data visualisation would help generate meaningful and actionable insights. In the session on “Rethinking Financial Data”, Jill Lagos, Head of Policy at EMTECH reiterated, “Supervisors don’t just need raw data, they need software that makes this data consumable”. Consequently, without interactive dashboards and real-time analytics, gender-disaggregated data will not drive meaningful policy change.

BNR has already implemented an interactive dashboard allowing supervisors to filter financial data by gender, economic activity, financial product type, and geographical region.

TechSprint solutions and their application to addressing digital payment fraud in West Africa

“Fraud is borderless, and Africa is experiencing a surge in cyber fraud cases. Regulators need AI-driven real-time monitoring tools to keep pace with evolving threats.” – Grace Mathebula, Alliance for Innovative Regulation

As the adoption of financial technology in Africa increases, there is also a growing risk of cybercrime and fraud within the region’s financial markets. Statistics show a grim picture in relation to the scale of fraud losses experienced in African jurisdictions. For example, in the latest Report on Frauds and Forgeries in Nigerian Banks, the total amounts involved in Q3 2024 grew by 105 percent to NGN115.9 billion, up from NGN56.6 billion in the previous quarter.

Championed by the Alliance for Innovative Regulation (AIR), the TechSprint on Digital Payment Fraud in West Africa, as showcased during the SupTech Week 2024 brought different stakeholders together to co-create unique and practical fraud detection solutions. The TechSprint ran through October and November 2024, culminating in the presentation of prototypes on a Demo Day. The TechSprint community consisted of 20 innovators (“sprinters”) from Ghana, Nigeria, The Gambia, and the United Kingdom, working on seven projects. Notable innovations presented included:

- AI-driven market monitoring and fraud intelligence by 1% Lab: They developed Covenant AI that helps to automate fraud detection workflows, including real-time market monitoring, and a shift towards AI-generated fraud intelligence instead of relying solely on historical fraud data.

- Reducing false positives in fraud detection by ProDetect: False positives (cases where legitimate transactions are incorrectly flagged as fraud) are common in fraud detection practices. ProDetect developed an anti-fraud transaction monitoring system that reduces false positives by 60% by integrating machine learning.

- AI for mobile money fraud prevention by 010 Technologies: With mobile money being a high-risk area for fraud, 010 Technologies developed a real-time fraud prevention system for mobile wallets, incorporating AI-driven risk profiling, automated transaction monitoring and a real-time fraud intelligence-sharing platform for regulators.

The demo sessions further emphasised that the solutions developed in this techsprint were not just for financial institutions; regulators must also integrate such tools into their supervisory frameworks.

Emerging technological trends and strategic imperatives

Several exciting technological trends are emerging that promise to reshape financial supervision. Real-time monitoring capabilities, AI-driven analytical frameworks, advanced social media sentiment analysis tools, and contextualised technological solutions are increasingly sophisticated. These developments point to a future where financial supervision is more predictive, responsive, and aligned with the rapidly evolving digital landscape.

The path forward demands a multifaceted approach. Financial regulators must focus on developing comprehensive suptech roadmaps, strengthening regional technological collaboration, investing in continuous capacity building, and prioritising solutions that are deeply rooted in local market realities. Organisations like the Cambridge SupTech Lab are playing a crucial role, offering collaborative technological development, annual innovation leadership programmes such as the Innovation Leaders Residency Programme, and global expertise transfer.

Conclusion

The SupTech Week 2024 reaffirmed that Africa is not just participating in the suptech revolution, it is actively shaping it. Whereas the discussions highlighted that suptech adoption remains uneven and bridging the gaps will require sustained investment in capacity building, cross-border collaboration, and regulatory alignment, there are success stories that show the potential and commitment of African supervisors towards technology-driven supervision environments.

As we look to the future, one narrative becomes crystal clear: the technological transformation of financial supervision in Africa is not a distant possibility, but an unfolding reality. The continent is not just participating in the global technological revolution, it is emerging as a key architect of its future.