ABOUT US

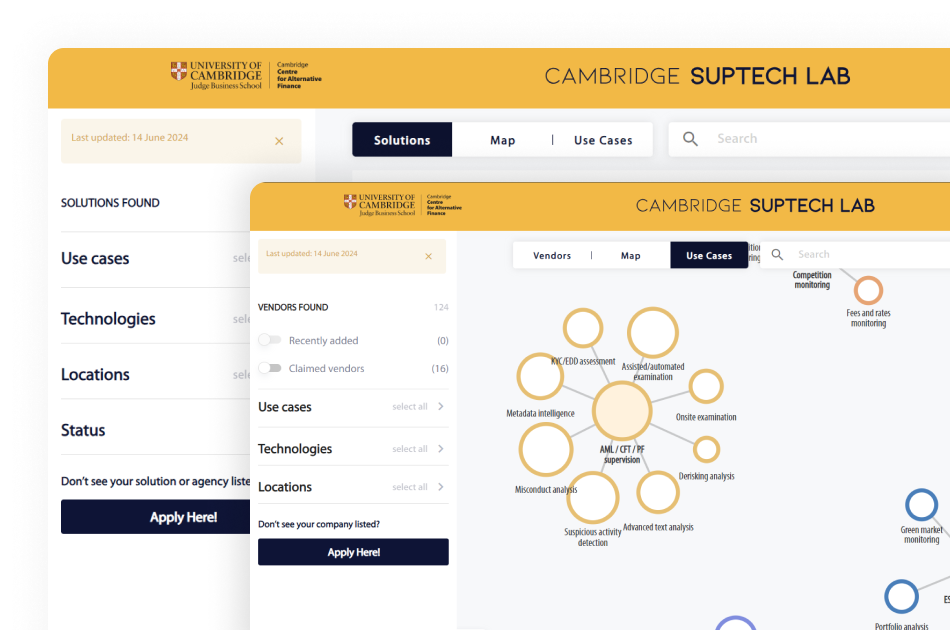

The Cambridge SupTech Lab accelerates the digital transformation of financial supervision and supervisory agencies. The Lab delivers world-class online leadership education, experiential training, ground-breaking research, market intelligence, new analytical frameworks, innovative digital tools, and cutting-edge suptech applications.

Financial supervisors

trained from 40

countries

Suptech proofs

of concept

created

Financial authorities from 120+ countries

surveyed on the state of suptech

Suptech applications prototyped

Digital tools users

Users on data gymnasium (alpha)

Suptech applications prototyped

Agency reports with 9,500+ responses in the

Digital SupTech

Diagnostic

Participants at Suptech Week

VISION

MISSION

Accelerating the digital transformation of financial supervision.

Manifesto

Outlining our core beliefs and strategic vision, this manifesto serves as a guiding framework for our commitment to innovation, integrity, and excellence in all our endeavours and initiatives.

- Effective digital supervision and regulation of the financial sector are critical components to making our economies and societies more equitable and sustainable. We’ll enable sustainable delivery of innovative financial services, greater protection of consumers, and the pursuit of other policy objectives such as financial stability and integrity, as well as more accountability in the management of environmental, governance, and other emerging risks.

- We believe in reducing the current dependency on the relatively scarce, expensive set of international experts and instead developing an online community supported by augmentative digital tools to increase financial authorities’ capabilities and peer-collaboration among supervisors.

- We are also a home for answering deeper, longer-term questions around collaboration and the adoption of technology across the global supervisory community. For example: Where are the opportunities for cross-jurisdictional collaboration? How might data be more effectively shared via data commons or exchanges? What components of the suptech solutions live in the private sector’s vendor marketplace vs as digital public goods vs open-source software?

Principles

Foundational values guiding our actions and decisions for sustained excellence and integrity

- Our initiatives are gender intentional, aiming to seek and encourage the participation and engagement of female regulators, supervisors, and technologists, as well as incorporating gender equality / inclusiveness into the design of the suptech applications and conceptualisation of data analytics.

- Moreover, we are very intentional in designing and developing applications that level the digital divides rather than deepening them. We intend to drive fairness in AI systems reducing algorithmic bias. We are aware that technology can exacerbate exclusion. Therefore, our explicit goal is to use data and tools for better inclusion outcomes.

- We are also keenly aware of the sustainability challenges of the 21st century and strive for environmental sustainability in our work settings

Launch of THE

Cambridge SupTech Lab

Mauro Guillen

Dean of Cambridge Judge Business School

Benjamin E. Diokno

Governor, Central Bank of Philippines