The Cambridge SupTech Lab accelerates the digital transformation of financial supervision to foster resilient, transparent, accountable, sustainable, and inclusive financial sectors.

The Lab catalyses the integration of innovative technologies and data science into supervisory processes to meet both enduring and emerging challenges in the rapidly changing financial landscape. Through the Lab, financial authorities have championed the adoption of advanced suptech solutions to address pressing issues such as financial crime, fraud, exclusion, climate change enablers, consumer protection, and artificial intelligence biases.

Our global, multidisciplinary team has partnered with financial authorities’ executives, supervisors, and data scientists to craft solutions throughout the entire innovation lifecycle, from data governance to AI-powered strategies, from the drawing board to full-scale deployment and expansion of cutting-edge suptech applications.

The Lab is housed at the Cambridge Centre for Alternative Finance (CCAF), University of Cambridge Judge Business School, leveraging foundational intellectual property and know-how from the RegTech for Regulators Accelerator (R2A).

What We Do

Research &

Intelligence

Insights to help financial authorities stay on top of digital transformation and suptech trends and developments.

Capacity

Building &

Education

Online training programmes and educational resources to develop the skills required to support and lead a digital transformation and suptech adoption.

Application

Incubation

De-risked suptech prototype development and deployment with established vendors.

Technical

assistance

Technical support and expert advice in digital transformations and suptech adoption.

Digital Tools

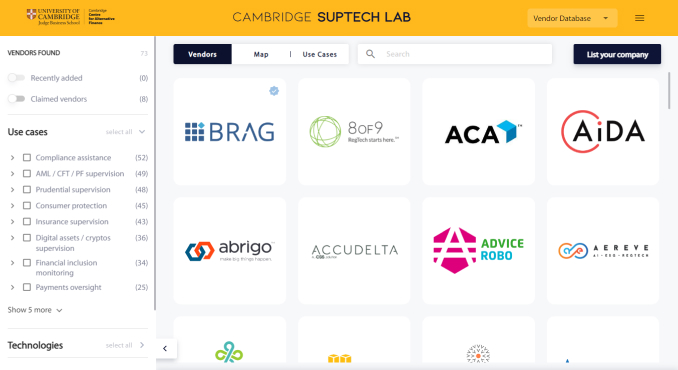

SupTech Vendor Database

The SupTech Vendor Database is a dynamic, web-based tool to explore off-the-shelf suptech applications and connect with vendors.

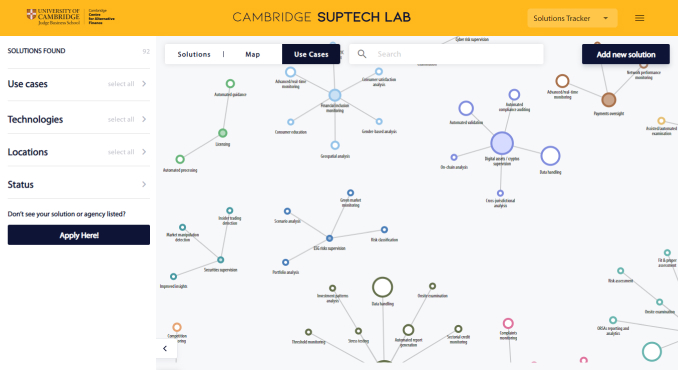

SupTech Solutions Tracker

The SupTech Solutions Tracker has been designed to allow users to navigate our global catalogue of financial authorities’ suptech solutions by use case, status and geography.

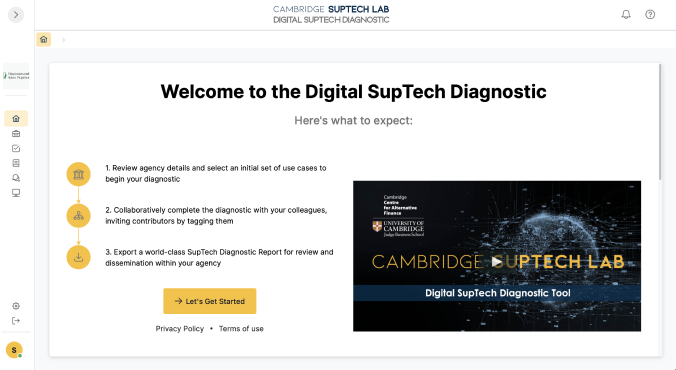

Digital SupTech Diagnostic

The Digital SupTech Diagnostic is an application that provides financial authorities with a snapshot of their capabilities by assessing their digital infrastructure, data architecture, tech stack, processes and key roles across a comprehensive set of supervisory use cases.

Blog

Suptech vs financial crime: Unlocking the full potential of data and digital tools in the fight against illicit financial flows

* Keynote presentation during the 3rd Symposium of the Global Forum on Illicit Financial Flows and Sustainable Development, June 4th and 5th, 2024 In today’s rapidly evolving digital landscape, data is the cornerstone of effective anti-money laundering and countering the...

Read more

Suptech and greenwashing: A desirable paradigm shift

By Maryeliza Barasa and Samir Kiuhan-Vasquez Retail and institutional investors increasingly choose to invest in assets that align with biodiversity, climate, and other sustainability goals. This trend has led to a surge in the number of financial products claiming to...

Women in banking: Interview with Sonja Kelly, Women World Banking

For the month of March, in honor of International Women's Day, the Cambridge SupTech Lab will be featuring inspiring leaders of women in finance and financial supervision. We asked them questions about women in banking as well as about career advice and mentorship....

Women’s economic empowerment: Interview with Clara Arthur, United Nations Capital Development Fund (UNCDF)

For the month of March, in honor of International Women's Day, the Cambridge SupTech Lab will be featuring inspiring leaders of women in finance and financial supervision. We asked them questions about financial inclusion as well as about career advice and mentorship....

News

In the SupTech Loop #26

Hi SupTech Community, Welcome to the 26th issue of the Cambridge SupTech Lab bi-weekly LinkedIn newsletter, a source for updates on recent innovations, breakthroughs, opportunities, upcoming events in the suptech field, and news from the Cambridge SupTech Lab team. If...

In the SupTech Loop #25

Hi SupTech Community, Welcome to the 25th issue of the Cambridge SupTech Lab bi-weekly LinkedIn newsletter, a source for updates on recent innovations, breakthroughs, opportunities, upcoming events in the suptech field, and news from the Cambridge SupTech Lab team. ...

In the SupTech Loop #24

Hi SupTech Community, Welcome to the 24th issue of the Cambridge SupTech Lab bi-weekly LinkedIn newsletter, a source for updates on recent innovations, breakthroughs, opportunities, upcoming events in the suptech field, and news from the Cambridge SupTech Lab team. ...

In the SupTech Loop #23

Hi SupTech Community, Welcome to the 23rd issue of the Cambridge SupTech Lab bi-weekly LinkedIn newsletter, a source for updates on recent innovations, breakthroughs, opportunities, upcoming events in the suptech field, and news from the Cambridge SupTech Lab team. ...

Events

Accelerating the Digital Transformation of Financial Supervision in LAC

Accelerating the digital transformation of financial supervision in Latin America and the Caribbean (LAC) involves a comprehensive approach that integrates research, capacity building, technical assistance, and ecosystem development. The Asociación de Supervisores...

Why SupTech, Why Now?

Matt Grasser spoke at the Asociación de Supervisores Bancarios de las América (ASBA) event held on July 24, 2024, in Costa Rica, which brought together key representatives from financial authorities across Latin America and the Caribbean (LAC), focusing on suptech and...

SupTech Hackathon 2023

The collaboration between the Cambridge SupTech Lab and the Alliance for Innovative Regulation (AIR) culminated in the SupTech Hackathon 2023. This event, held virtually from July 26 to August 4, convened data scientists, innovators, and technologists from around the...

Next GenAI Tech Showcase

The Cambridge SupTech Lab and the Alliance for Innovative Regulation (AIR) held an open call for generative AI (GenAI)-enabled solutions that could address some of the challenges that financial authorities face. The showcase helped financial authorities to understand...